Data-Led Growth: How FinTechs Win with App Event Analytics

In the rapidly shifting world of financial technology (FinTech), acquiring and retaining new customers to achieve long-term business growth requires a proactive approach to user experience and application performance optimization. As FinTech companies compete against rivals to grow a user base and revolutionize how consumers manage their finances, they increasingly depend on data-driven insights to optimize their mobile applications and deliver exceptional user experiences. This is where application event analytics comes into play.

App event analytics is a powerful capability for the FinTech industry, enabling companies to collect, track, and analyze event data, (e.g. user engagement, transactional data, etc.) within their mobile apps. By harnessing the wealth of event data generated by users during the customer journey and captured through app event analytics, FinTechs can make data-driven decisions to optimize the user experience, improve application performance, drive user acquisition and retention, enhance security, and ensure regulatory compliance.

In this blog, we’re taking a closer look at how FinTechs can approach app event analytics to make the most of their event data. We’ll explore what kinds of events can be tracked, how app event analytics can drive FinTech customer and revenue growth, specific use cases for analyzing event data, and how to build a FinTech app event analytics architecture in AWS.

Understanding App Event Analytics

Application event analytics is the process of collecting, processing, and analyzing event data from a mobile or web-based application. Event data consists of machine-generated logs that are automatically written each time a user takes an action on the FinTech app. Such actions can include:

- Downloading the app,

- Creating a new account,

- Logging into the app for the first time,

- Logging into the app as a returning user,

- Clicking on any link within the app,

- Navigating to specific features within the app,

- Taking actions like submitting a query or making an API request,

- Scrolling or swiping on a specific page or application feature, or

- Completing specified conversion actions within the app (e.g. applying for a loan, purchasing stock, making a deposit, etc.)

Event logs contain many data points, including a timestamp that indicates when the event transpired, a unique event code that unambiguously identifies the event, and a description of the event and its severity. Event logs that result from user-generated actions may be attached to a User ID and related user data (e.g. first and last name, email address, country/region, session ID, etc.).

In addition to user behavior and engagement data, FinTechs can also analyze transactional and application performance data with app event analytics. Event logs can be generated whenever a transaction takes place on the application or in response to an unexpected application error or crash.

User activity and engagement log data can optimize the user experience, customer acquisition process, and overall customer journey, while transaction logs help FinTechs measure customer value, predict future customer behaviors, and manage risk. Analyzing data from application errors or crash events can also help FinTech companies diagnose and remediate software bugs that negatively impact the customer experience.

What Can FinTechs Track with App Event Analytics?

FinTech product teams can use app event analytics to gain insight into the customer journey and understand how users are engaging with the app.

When users engage with the app, such as by registering an account, navigating to a specific feature, or completing a transaction, they trigger events which are automatically captured in application event logs.

In addition to capturing user engagement and interactions, FinTech developer teams also use app event tracking to record in-app transactions and capture application performance issues (e.g. errors, crash reports, timeouts, high latency events, etc.).

Let's take an in-depth look at what types of events can be tracked with app event analytics.

User Activation Events

Driving new user activations is a critical objective for FinTech start-ups seeking to gain new customers and increase their market share through a product-led growth strategy.

FinTech companies can use application event analytics to capture data about user activation and onboarding events. This include tracking events like:

- Downloading or installing the app on a device,

- New registrations and sign-ups,

- Completing email verification,

- Logging into the app for the first time as a registered user,

- Linking a user profile to a bank account or credit card, or

- Completing a first transaction on the platform.

For most FinTech apps, customer acquisition and onboarding is a complex process that spans multiple touch points. Capturing and analyzing data from user acquisition events can help FinTech product teams streamline this process to win more customers, increase the success of customer onboarding, and achieve faster growth.

User Engagement Events

To enhance product-market fit and optimize user experiences, FinTech companies need to understand how users are engaging with the application to achieve their goals.

With in-app event tracking, FinTech product teams can capture data on a variety of user activities, including:

- Opening the application on any device,

- Navigating to any application feature,

- Clicking on any button in the application, and

- Scrolling, or swiping inside the app.

Even user actions that are unproductive can be logged as an event. For example, an event can be logged when a user clicks on the same button multiple times in rapid succession - possibly indicating their frustration with a slow or non-responsive feature.

FinTech product teams can analyze user engagement data to answer questions like:

- What application features are the most popular?

- How do app users spend most of their time on the app?

- How can we organize the app to make navigation easier for users?

- How can we streamline the user experience to make it easier for users to accomplish their goals?

- How frequently do specific users engage with the app? How long do user sessions last? How long does it take to perform key user activities?

User Retention Events

Achieving business growth isn’t just about attracting new users, it’s also about maximizing user retention by ensuring that customers are getting genuine value from the product. FinTech companies can use app event analytics to look at the behavior of individual users or user cohorts over time and assess user retention. This can involve aggregating event data to ask questions like:

- How many daily or monthly active users are we seeing on the application?

- How many times is the average existing user (or a user in an identified user cohort) opening the application each month?

- What percentage of users have accessed their account in the past week/month?

- How long is the average user session?

Conversion Events

A conversion event is any user action that has value to your business. FinTechs define conversion events based on the unique products and services they provide:

- For a FinTech business in the lending space, a conversion might be counted when the user is approved for a new loan or line of credit.

- For a digital bank, a conversion might be counted when the user creates a new account and makes their first deposit.

- For a stock purchasing product or cryptocurrency exchange, a conversion could be counted when a user makes their first trade.

FinTech product teams can use app event tracking to count these high-value conversion events, correlate them with other types of user activity, and develop new strategies for streamlining the conversion process, increasing FinTech conversion rates, and maximizing revenue.

Application Errors and Crashes

Application errors and crashes negatively impact the user experience and may also degrade consumer trust in a FinTech product.

FinTech companies can use app event tracking to gather data on errors, crashes, and other performance issues that users encounter while engaging with the application. Product teams can review data from user sessions that ended with an error or a crash to diagnose and remediate software bugs and improve the user experience.

How Can App Event Analytics Drive FinTech Business Growth?

1. Streamlining the User Activation Process

For most FinTech apps, user activation is a multi-step operation that funnels new users through the process of downloading the application, creating an account with their personal data, confirming their identity through external communication channels (e.g. email or phone), and completing their first transaction on the platform. A typical user activation might include the following steps:

- A new user downloads the app.

- The user registers a new profile.

- The user confirms their identity by responding to an email or text message.

- The user links their bank account to their profile.

- The user deposits money into the platform.

- The user executes their first transaction.

With app event analytics, FinTech product teams can apply funnel analysis to the user activation process, measure conversion rates for each stage of the funnel, and identify the most significant drop-off points for new users. From there, fintech product teams can make targeted improvements to the user activation process that will have the biggest impact on accelerating new user activations.

Two examples:

- If new users are slow to register a new profile, the product team could make the process faster by enabling registration through an existing Google or Microsoft account. They could also implement a pop-up window showcasing this feature and prompting new users to register.

- If new users are slow to deposit money into the platform, the product team could reduce the minimum deposit amount or introduce language to assure users that their deposits are secure.

2. Reducing Friction in the Customer Journey

Active users on a FinTech application will use the app regularly to accomplish a variety of goals. Depending on the app, user goals can include things like checking an account balance, reviewing stock or cryptocurrency prices, withdrawing or depositing money, or executing a trade.

The sequence of actions a user takes to accomplish their goal is known as the customer journey. Product teams can use app event analytics to ask questions like:

- What are the most common activities users engage with on the platform?

- What are the most common goals for users? What do users want to accomplish when they open our app?

- How can we streamline or optimize the customer journey to make it easier and faster for users to accomplish their goals?

Here are two examples of how Fintechs could use app event analysis to improve the customer journey:

- A stock trading app allows users to purchase stocks listed on the NYSE, TSE, and the NASDAQ. Event data shows that returning users will search for information about the same stocks each time they visit. The product team notices this and implements a feature where users can “favorite” stocks and build a custom dashboard with updated pricing and trends for their preferred stocks. This makes it faster and easier for users to access information on their favorite stocks and enhances the user experience.

- A digital banking app allows users to pay bills or send payments to friends electronically. Event data shows that users are making a lot of these electronic transfers, but it takes three clicks for users to navigate to this feature after logging in. The product team implements a UI change by moving the menu option for electronic transfers to the “welcome screen”. This makes it faster and easier for users to access the electronic transfer feature and enhances the user experience.

3. Resolving Application Performance Issues to Drive Conversions

Application performance issues, errors, or crashes can negatively impact conversions on any FinTech app, especially if they occur while users are actively attempting to finalize a transaction or another conversion action. FinTech product teams can use app event analytics to gain deeper application insights, track errors and crash reports, identify bugs that are hurting revenue, and efficiently allocate resources to resolve those issues.

Here’s how using this data to improve conversions might look for a Fintech:

- A credit/lending app allows users to submit loan applications, which are counted as a conversion action. Event data shows that some users are experiencing a software glitch that causes the application to crash when they press the “submit application” button. As a result, their application doesn’t get submitted and their time is wasted, which discourages the user from applying again.

The product team identifies this issue using app event analytics and prioritizes it for resolution because it has a significant impact on revenue. The product team reviews user sessions to understand the bug and identify its root cause. Once the bug is fixed, the application stops crashing and conversion rates increase.

Looking for more event analytics use cases?

Building FinTech App Event Analytics Architecture with AWS

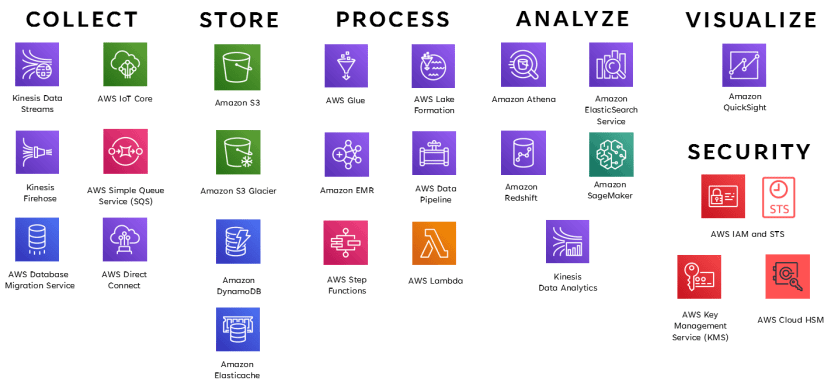

Before FinTechs can leverage application event data for valuable insights, they must set up the necessary IT infrastructure to collect, aggregate, normalize, and analyze the data. This includes:

- Identifying Events to Track - FinTech product teams must determine which events will be tracked or analyzed within the application and what supporting data should be included with event logs. Some event data may be captured automatically, but product teams can also define custom events to track.

- Implementing Event Tracking - FinTech apps that are hosted on AWS can have their event logs collected by Amazon CloudWatch. For FinTech iOS and Android applications, dev teams must use the AWS Mobile SDKs to integrate the app with AWS backend services and push event logs into AWS to enable mobile app analytics.

- Storing the Event Data - Once the event logs are being shipped to AWS, FinTechs can use Amazon Kinesis Event Stream to stream application data into Amazon S3 buckets for storage. With its high scalability, durability, and tiered storage options, Amazon S3 provides the best storage backing for a FinTech event data lake.

- Transforming and Processing Data - FinTech product teams need the ability to transform, manipulate, and aggregate event data in different ways to develop valuable insights. Tools like AWS Glue and AWS Lambda can facilitate real-time batch processing and transformation on event data.

- Analyzing Event Data - After applying transformations, FinTech product teams can analyze their event data using analytics tools like Amazon Athena (Amazon’s serverless querying service) and Amazon Redshift (Amazon’s cloud data warehouse capability).

AWS provides a variety of tools that can help FinTech companies extract insights from event data.

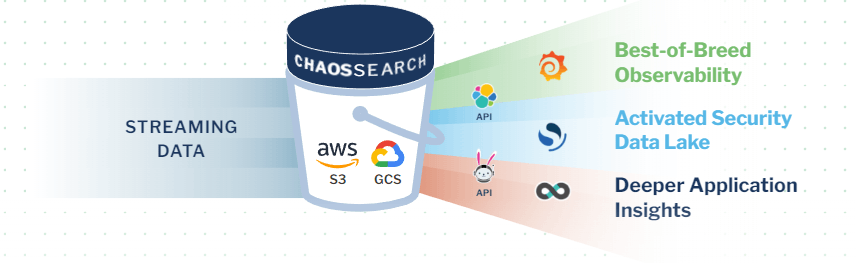

Power FinTech Application Observability with ChaosSearch

ChaosSearch underpins a best-of-breed observability strategy by analyzing data directly in our customers’ Amazon S3 storage, making it faster, cheaper, and easier for FinTechs to do log analytics on AWS.

Our proprietary Chaos Index® technology automatically indexes event data as it lands in S3 buckets with up to 95% data compression. Event logs are often written into a JSON file, so we created JSON Flex®: a unique way of storing and processing JSON files that maintains the smallest possible data representation while giving users full customization to materialize the data as needed at query time.

From there, FinTechs can use our Chaos Refinery® tool to apply virtual transformations to their data, analyzing it in unlimited different ways with no data movement, no ETL process, and no changes to the underlying data representation. Once the event data has been transformed, FinTech product teams can use our built-in Kibana tool to visualize the data and extract insights.

With ChaosSearch, FinTech companies can minimize the time, cost, and complexity of leveraging app event analytics into a competitive business advantage.

Ready to learn more?

Check out our free-to-access white paper on The Hidden Value of Log Analytics for Financial Services to discover how event analytics can help your FinTech business troubleshoot application performance issues, detect and investigate security threats, and more.